If you would like to have your charitable gift benefit the Billings TrailNet into perpetuity and be eligible for the Montana Qualified Endowment Credit, you can make a gift to either the BYCT – Billings TrailNet Endowment which is administered by the Montana Community Foundation or the Billings TrailNet Endowment which is administered by the Billings Community Foundation. Both endowments are qualified endowments under applicable Montana law. For a charitable gift to be eligible for the Montana Qualified Endowment Credit, it must take the form of a planned gift. The most common planned gifts that can benefit the endowment of a Montana charitable organization are a charitable gift annuity and a deferred charitable gift annuity. Both the Montana Community Foundation and the Billings Community Foundation can assist you with the documents that are necessary for establishing a charitable gift annuity or a deferred charitable gift annuity.

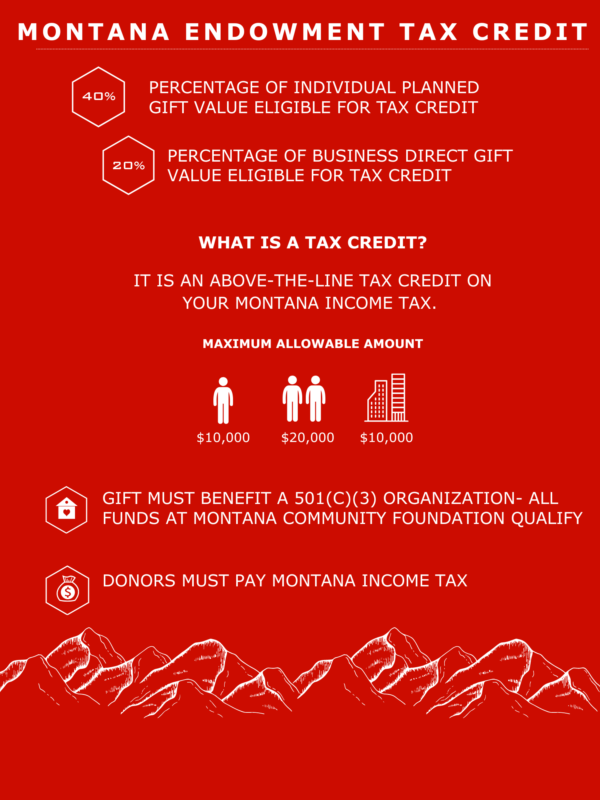

The Montana Qualified Endowment Credit is a dollar-for-dollar credit against the donor’s Montana income taxes. An individual taxpayer is eligible for a state income tax credit for the year of the gift in an amount equal to the lesser of 40% of the present value of the aggregate amount of the charitable gift portion of the planned gift or $10,000. Therefore, in order to receive the full $10,000 state income tax credit for the tax year of the gift, the present value of the aggregate amount of the charitable gift portion of the planned gift to the qualified endowment must be $25,000. A married couple that makes a joint planned gift and files their Montana individual income tax return jointly may claim a Montana Qualified Endowment Credit in an amount up to $20,000 for the year of the gift. In order to receive the full $20,000 state income tax credit for the tax year of the joint planned gift, the present value of the aggregate amount of the charitable gift portion of the joint planned gift must be $50,000.

If the donor of a planned gift to a qualified endowment separately itemizes the donor’s income tax deductions on a federal individual income tax return, the donor will also be able to claim the present value of the aggregate amount of the charitable gift portion of the planned gift as a charitable income tax deduction on the federal tax return. In order to claim a charitable income tax deduction on a federal individual income tax return, the donor must not be taking the standard deduction.

An individual donor can fund a planned gift that is eligible for the Montana Qualified Endowment Credit with cash, publicly traded securities, mutual funds, and other investment assets that can be easily liquidated. If you desire to fund a planned gift with an asset that cannot be easily liquidated, you should talk with a representative of either the Montana Community Foundation or the Billings Community Foundation about the particular asset that you wish to use to fund your planned gift.